Here’s a simple question to any business owner, why are you in business? The flippant answer I often hear is to make money. An honest, if not inspiring answer. But there is a fundamental flaw in that statement which many business owners fails to comprehend. They start a business, typically through experience in, or a passion for the field or because they have seen an opportunity to make money, but fail to achieve that ultimate goal because they fail to plan their end, their exit strategy. Thinking through your exit plan from your business should start when you plan your business on day 1, not wait until the end if you want to leave on your terms. Learn more about a good business starts with the exit in mind, THINK EXIT

Are you YOUR business?

If you can’t get out making the money you intended to when you sell up then why did you set up the business in the first place? You have a great idea, you work on it, and spend your energy (and life) building your business until it becomes you. It succeeds and you enjoy the lifestyle it brings. Then the real challenge of maximising that income to free yourself up and retire or do something else begins.

That final stage often becomes impossible because you are the business and it is you, its lifeblood, main cheerleader and driving engine. To any potential buyer, they see that you are the business, its key asset and real value. This is why buy-out clauses often tie-in existing business owners so that the value that the former owner delivers can be transferred to the new owner. This is a typical scenario of being a successful business owner.

Business owners are driven by the passion to run the business day-to-day. This often overshadows the failure to plan the owner’s exit strategy from the start. To achieve that, owners must build a business with the clear objective to enable the owner to get out and maximising the sale value from what they have achieved. Nearly all business owners focus on building a successful business, but not on making sure they maximise their returns from the successful ownership of the business they exit.

Exit Strategy Planning

The real payback from all that hard work in creating and setting up a business for an entrepreneur is the final payback. It is in the shareholder value being realised by a sale of that business. Few owners think about realising their shareholder value, being more interested in the Profit & Loss than the Balance Sheet when making key decisions about the business.

That approach is effectively summarised in the phrase; the turnover is vanity, profit is sanity and cash is king. This great motto in the running of any business. But it does not hold true in achieving exit strategy success as a business owner.

Exit Strategy: think like a Shareholder

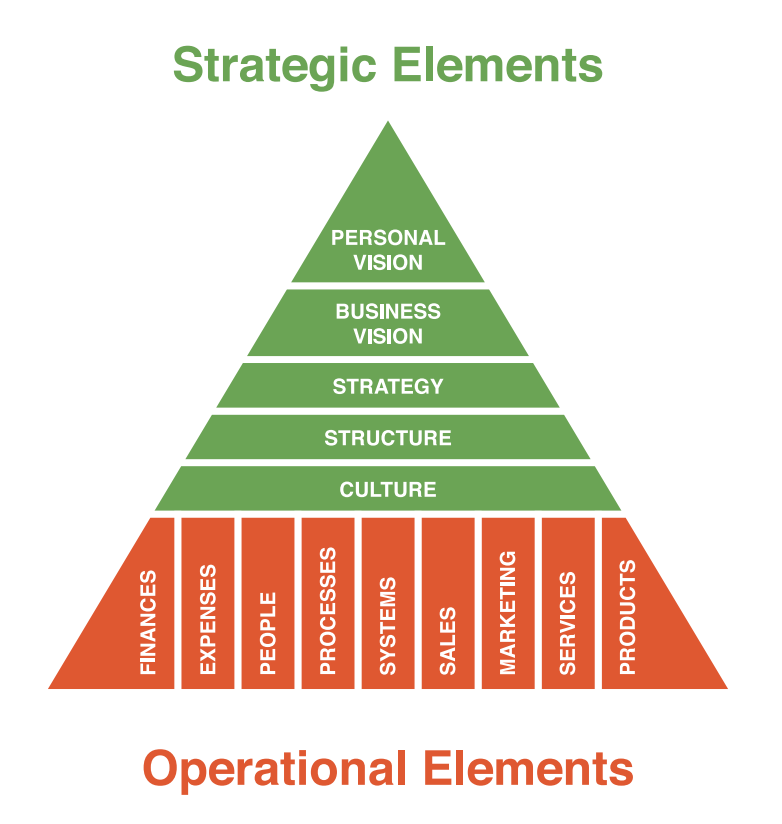

Achieving shareholder success is the only motto to follow if you want to have a saleable asset. Owners need to focus on developing an exit strategy which achieves their personal goals. While profit and cash rule the day, building a valuable asset requires building shareholder value, through building sustainable long-term profitability.

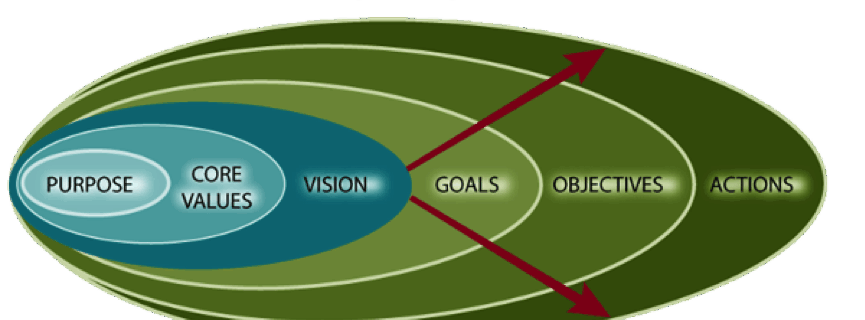

Success in business requires owners to build a business which you own but are not concreted into the business foundations. Building a forward strategy for your business is a vital first step in building your exit strategy. It is the old adage that you need to work on your business not in your business for success. This great motto underpins successful entrepreneurs.

THINK EXIT is Long-Term Thinking

Short-term profitability is always an important goal. But long-term share value is a strategic consideration which owners need to consider in building the value of their business. SO a good business starts with the end in mind, THINK EXIT.

If you would like to discuss this article further or further information about our services in working with business owners in achieving successful exit strategies then contact us at enquiries@cowdenconsulting.com or see our contact page for further options.

Like to learn more about creating and leading a business, with a successful exit strategy in place? Then click here to buy the book with all the tools you need to become a better leader: Strategy The Leader’s Role by Richard Gourlay

Read more “A good business starts with the EXIT in mind, THINK EXIT”